2022 Form 1040 Schedule 4. Form 1040 Schedule 4 Other Taxes asks that you report any other taxes that cant be entered directly onto Form 1040. List your parents CURRENT marital status.

Estimate your current 2020 January 1 - December 31 2020 Taxes - due April 15 2021 - with this 2020 Tax Calculator and Refund Estimator. Form 1040 Schedule 4 was used in the 2018 tax year for reporting other taxes you may have owed above and beyond your federal income taxes. Schedule D Capital Gains and Losses is an attachment of Forms 1040 and 1040-NR.

Schedule D is a rather simple tax form thats very important as youll need to report every capital gain.

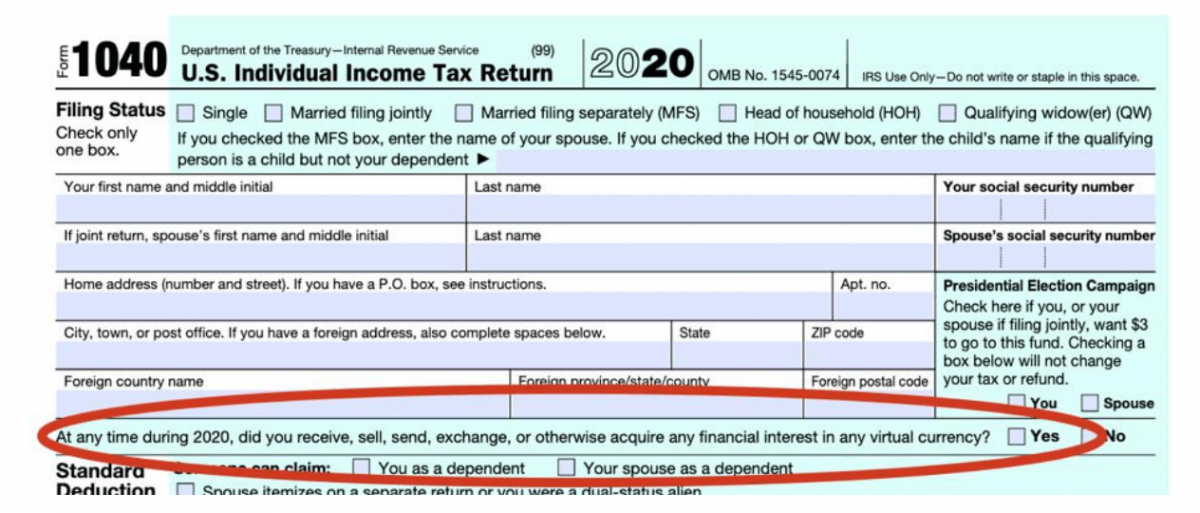

SCHEDULE 4 Form 1040 Department of the Treasury Internal Revenue Service Other Taxes Attach to Form 1040. Column h all lines should reflect the actual calculation of Gains or Loss. In 2018 the IRS and the Treasury Department redesigned Form 1040 with simplification as the goal. Then taxpayers with.