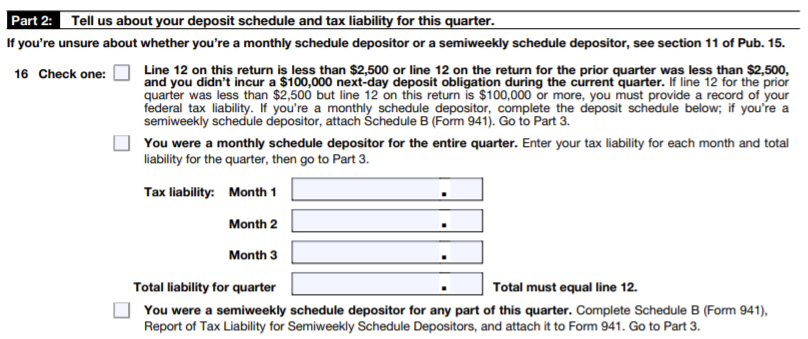

2022 Form 941 Schedule B. For Paperwork Reduction Act Notice see separate instructions. Schedule B Form 941 - IRS tax forms Total must equal line 12 on Form 941 or Form 941-SS.

It involves a lot of nuances but generally if your employment taxes exceed 50000 and your overall tax liability is at least 100000 you qualify. Simply apply a FREE Online Signature PIN with TaxBandits. Form 941 also known as Schedule B reports how much federal income tax and payroll taxes youve withheld from employee paychecks.

This form is only required for businesses with employees.

Schedule B Form 941 TaxBandits helps to report Form Schedule B tax liability and semiweekly deposit schedule and transmit it directly to the IRS. Simply apply a FREE Online Signature PIN with TaxBandits. Every quarter the employer has to report the withholding information in Form 941 Schedule B. Instructions for Schedule B Form 941 Report of Tax Liability for Semiweekly Schedule Depositors.