941 Schedule B 2022. Schedule B should be filed with Form 941 to report the federal income taxes withheld from the employees wages and employer and employee portion of social security and Medicare taxes. If they have accumulated 100000 or more in tax liabilities for the current or past calendar year.

See also 2017 2020 Form IRS 941 Schedule B Fill Online Printable from Schedule Topic. Enter the deposit schedule tax liability for the quarter. Fillable Schedule B Form 941 Report Of Tax Liability Uploaded by admin on Saturday July 24th 2021 in category Schedule.

You are a semiweekly depositor if you.

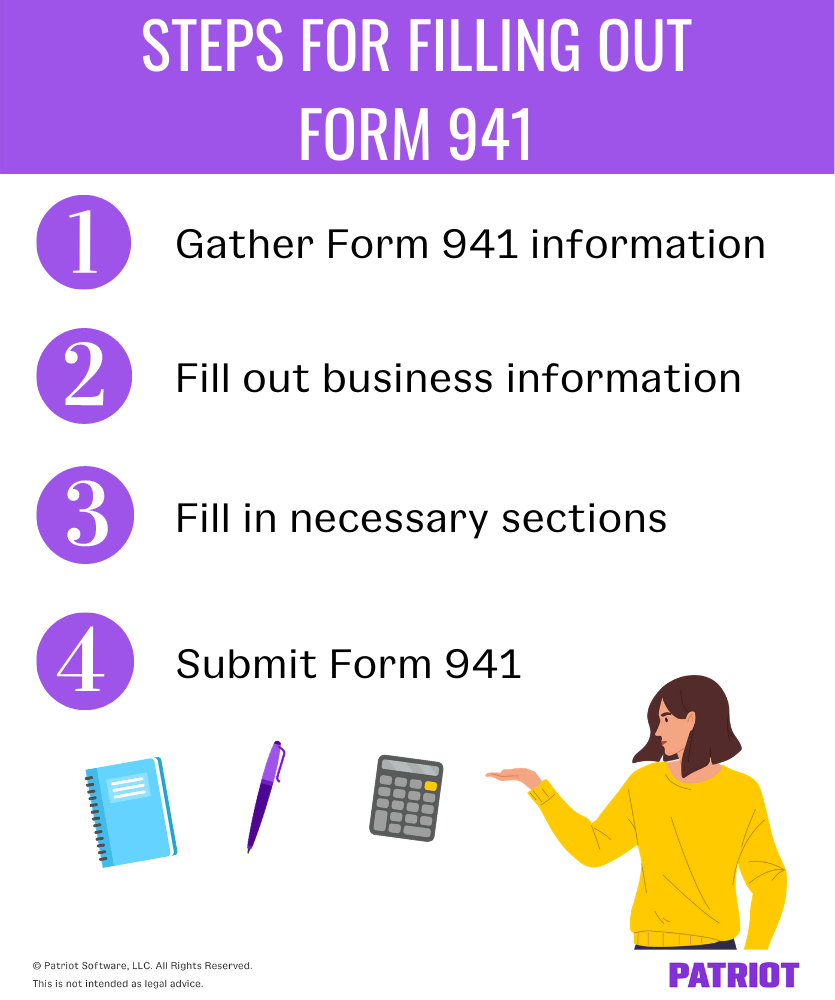

Schedule B is filed with Form 941 or Form 941-SS. You are a semiweekly depositor if you. Schedule B Form 941 Companies that run services as well as utilize employees under their business are most likely needed to file Form 941 provided by Internal Revenue Service four times a year. More In Forms and Instructions.